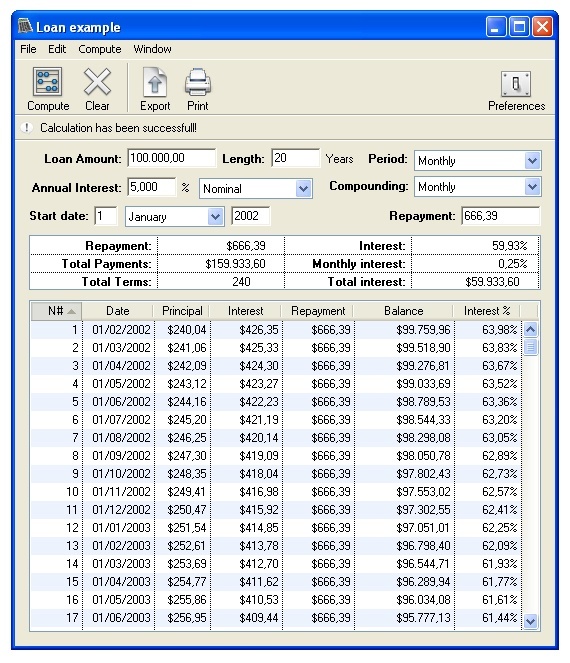

While it doesn’t offer loans itself, it can help your business qualify for lower rates and better repayment terms. SBA loan: The SBA (Small Business Administration) backs loans for businesses.Because the equipment acts as collateral, they tend to have lower rates than unsecured installment loans. With a balloon payment, the payments are generally interest-only or low. Equipment loan: Equipment loans are term loans secured by the equipment your business needs to buy. How it works is that the loan is amortized or spread out over a long period of time.Commercial real estate loan: If your business is ready to open a brick-and-mortar location, a commercial real estate loan gives you the funding to buy property or sign a leasee.As you pay back what you’ve borrowed, your credit limit resets and you can borrow more as needed. You can draw funds from it as needed and only pay interest on what you borrow. Line of credit: A business line of credit functions like a credit card.These are one of the most common options, and you can find them offered by both banks and online lenders. Installment loan: Installment loans - also known as term loans - allow your business to borrow a lump sum and pay it back in monthly payments.There are countless options out there, but these are the most common types of business loans. These generally include personal and business credit reports as well as financial and legal documents. Business Loan Amortization Schedule Investors or business owners can use the commercial loan calculator to generate a business loan amortization schedule for business loans. This balance needs to be refinanced or paid off. At the end of the loan term a balloon payment is due. Before applying for a business loan, ensure you have the necessary documents. The commercial loan calculator is easy to use with a commercial loan amortization schedule excel that you can view in details. Many commercial loans have a short loan length with a longer loan amortization period. Loan term: The time it takes to pay back the loan.Ī business loan could help your business succeed, but you should only consider taking one out if you are sure you can afford to pay it back.

COMMERCIAL LOAN CALC HOW TO

Interest: The cost of borrowing a business loan. How to Calculate Monthly Payments for Commercial Loans Use the formula in the image below to calculate the monthly payment for a commercial loan.Principal: The total amount your business borrows.

COMMERCIAL LOAN CALC FULL

The cost of a business loan is determined by four factors: Commercial Real Estate Loans Buy, refinance or use your equity Get started Loan amount from 25,000 Interest rate as low as 5.50 Loan terms up to 10 years with balloon payment up to 15 years with full amortization Fees 0.75 of amount financed Why use a commercial real estate loan Purchase the land or commercial property your business needs. You can also use a business loan to consolidate debt if needed. Business loans are ideal for small businesses that need help starting or growing their business. They are ideal for both expansion and large, one-time expenses. What to do when you lose your 401(k) matchĪ business loan is money that you borrow specifically to grow or maintain your business. Starting and running a business can be very expensive, especially in the face of rising inflation. Should you accept an early retirement offer? 504 loans have a formula prepayment penalty in their first ten years.How much should you contribute to your 401(k)? How to Use a Business Loan Calculator Enter the total amount of loan you want to borrow Plugin the annual interest rate (provided by your lender) Set the. 504 loans are fully amortizing loan with no balloon payments.

COMMERCIAL LOAN CALC PLUS

504 fees are to 2.65% of the 504 loan amount plus $2,500 and are financed with the project. Introducing the ultimate loan calculator app - the only tool youll ever need for all your loan calculations. 504 rates are fixed for 20 or 25 years, typically at the 10-year Treasury rate plus 2 1/2 to 3%. The final rate is set at the time of loan funding. The 504 rate is estimated based on current rates. You can negotiate rates and terms with your bank, provided they use at least a 10 year maturity. The bank loan amortization is typically 20 to 25 years and may carry a shorter term or due date. The actual amount of financing available will vary based on the project type, the applicant’s credit quality and based on the lesser of project cost and appraised value.īank interest rates are estimates and may be fixed or variable. The above estimated structure is based on 90% financing.

0 kommentar(er)

0 kommentar(er)